When Will the Supply Chain Recover?

By Chris Jensen —

The past two years have put an overwhelming amount of strain on the hardware industry’s supply chain, making it difficult for retailers to keep up with the constant changes.

During Orgill’s Spring Dealer Market in Orlando, Jeff Curler, executive vice president of purchasing, gave an overview on what the company is doing to help dealers overcome the supply chain challenges.

“The actions we took in January 2020 really helped us that spring. We learned it was not just a China thing,” Curler said. “Then we all spent 13 months working offsite, which created a new set of challenges.”

Covid has stabilized a little, he said, so there are three factors that are currently holding up the supply chain: raw materials, transportation/logistics and labor.

Demand has put pressure on raw material supply for plastics, wood, metals and paper. Competition for those materials has resulted in higher pricing, according to Curler. “This has mostly impacted North American manufacturing for paint products, plumbing and electrical due to resins. We are seeing some signs of improvement,” he said.

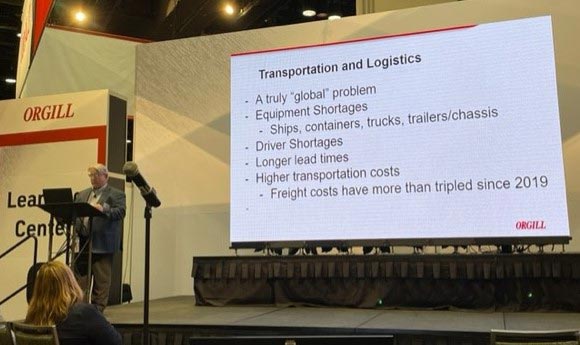

Transportation and logistics are truly experiencing a global problem with equipment shortages (ships, containers, trucks, trailers/chassis), driver shortages, longer lead times and higher transportation costs, Curler said, adding that freight costs have more than tripled since 2019.

In 2021 more than 47 million workers quit their jobs—that’s 14 percent of all Americans. The one factor where we see improvement is the labor market, Curler said. “Many of those who quit are now being rehired. A decline in covid is helping. Competition for workers is fierce and there are higher costs for employees,” he added.

Orgill started out 2020 with a fill rate of 95.7 percent, but that eventually fell to 82 percent for the year. The situation didn’t improve in 2021, as Orgill’s fill rate came in 78 percent, according to Curler, who said the biggest impact came from domestic manufacturing. He pointed out that 52 percent of their line cuts come from 30 vendors—23 are in the paint, plumbing or electrical categories. Sixty percent of cut lines are showing as “late” from the vendor and 43 percent have been identified as back-ordered from the vendor, Curler said.

What is Orgill Doing?

Orgill is pursuing a number of initiatives to improve the supply chain situation, according to Curler. “We are looking at some alternate vendors—we’ve added dozens of new suppliers and hundreds of new SKUs especially in PPE, cleaning supplies and commodities. We have pointed to alternatives that already exist in the system,” Curler said.

He added, “When Jarden/Ball had an inability to supply the industry with canning jars, we discovered Gossi to be a good alternative. Dealers are finding our Exclusively Orgill brands as an alternative to the brands when supply has been difficult.”

Curler said Orgill has plans to add vendors so that they have more options, particularly with commodities like PVC, coatings and plastics. “Unfortunately, many of those vendors do not currently have the capacity to take on a new distributor like Orgill as they are maxed out on production. We are also looking to consolidate vendors to drive more volume through a few vendors and therefore increasing our leverage with those vendors,” he said.

Inventory investment is another key initiative. “Our inventory on hand is currently up 34 percent from a year ago. Dealers are really using Exclusively Orgill, which is up $60 million. Fill rates for our Exclusively Orgill brands are approaching 95 percent,” Curler said. “On order is currently at more than $300 million. We have built up our on-hand inventory in preparation for the Spring Buying Event. We are releasing our promotional programs earlier than usual. We are ordering and receiving seasonal merchandise earlier than we would typically like.”

He added, “We migrated more than 1,700 warehouse vendors to our new buying system, Demand & Fulfillment, by the end of 2021. The system features more tools on hand, better seasonal algorithms, better Orgill-vendor information sharing and optimized promotional buying.”

According to Curler, the company is completely transparent with the latest information of supply chain setbacks and improvement. “Our weekly supply chain updates are just one example. We also share additional information with our sales team to better serve dealers,” he said.

Orgill has a new organizational structure separating the purchasing and replenishment functions. “We increased our operational capacity by opening a new DC in Rome, N.Y., and expanding our DC in Hurricane, Utah. Soon, all DCs will be operating with multiple shifts for shipping and receiving,” Curler said.

A Path to Recovery

According to Curler, “We do see signs of recovery in the short term. Many vendors are waiting this out; not investing for the long term if it will only bring short-term results. Many vendors are pointing us to the second quarter of this year for a recovery.”

Curler identified the following specific challenges faced by key categories:

Paint Products

Currently the highest line cut category. Major impact to supply as a result of resin shortages, though availability of resin is getting better.

Transportation could be a factor if finished products are made available. Paint sundries are delivering at high fill rates.

We expect to see significant improvement in this category in the April and May timeframe.

Outdoor Living

The vast majority of service level cuts are occurring within the pool chemical, propane fuel and vendors dependent on imported components of finished goods.

We see improvement prior to summer if Biolab can get its new facility that burned down last fall up and running.

Agriculture, watering and garden tools are in good shape, but recent news of major shortages of glyphosate will have the industry scrambling for alternatives.

Expect a continued rough spring with “lumpy” service levels.

Plumbing/Electrical/HVAC

Like paint, this category has been hit mostly by resin shortages.

PVC products in both plumbing and electrical are among the highest line cuts overall.

If Orgill can diversify and bring on other vendors in these categories, we could see nice improvements by late spring.

Southwire has lifted allocations but we are still seeing backorders. Expect max quantity limits to be lifted as backorders clear.

Low-cost, high-unit filters like fiberglass are becoming cost prohibitive and may become extinct in favor of paper or cloth-based filters.

This category is still probably a year away from significant recovery.

Building Products

Building products has had a lot of recent inconsistency in service level.

Latex-based products that require resins are in short supply as the priority at the mill is for cardboard boxes (Amazon).

High-line count, low-cost goods like hardware and fasteners are facing import delays with containers.

Despite that, this category had the highest service level of all for most of 2021.

We should see improvements to those levels in the next couple of months.

Tools and Automotive

We have had spotty issues with imports but typically our tool lines are delivering the mid-80s.

Power tools will continue to be a factor until chips needed in their construction become more available.

Our more recent issues have been with the automotive department. Most everything chemical-based, especially anti-freeze and washer fluid, have contributed to poor service level. That should improve nearly immediately as we come out of the cold weather season.

Expect significant improvements by late first quarter overall.

Curler said, “We did not see progress in 2021 except in imports. We saw the least improvement with domestic manufacturing, mainly paint, electrical and plumbing. One of the silver linings is that the industry is better prepared now for a natural disaster, because of all the steps we’ve been taking to address the supply chain challenges.”

He said long-term recovery of the supply chain hinges on two main factors: the return of consistent lead times on imports and the availability of raw materials for North American manufacturing.

Curler concluded, “We expect 2022 will see significant improvement in raw materials, but it will be well into 2023 and perhaps beyond before import lead times and shipping bottlenecks are resolved.”