Take Advantage of a Smart Way to Reduce Your Tax Bill

By Craig Cope

Robert Kiyosaki once said, “It’s not how much money you make, but how much money you keep, how hard it works for you and how many generations you keep it for.”

Without a doubt 2020 is a year that will not soon be forgotten. The pandemic and subsequent shelter-in-place orders have taken a wrecking ball to the retail market. According to S&P Global Market Intelligence the U.S. retail sector bankruptcies have reached a 10-year high.

However, the independent hardware channel has experienced record sales as an “essential business.” Ace Hardware CEO John Venhuizen was quick to highlight this point during an August 19, 2020 appearance on CNBC’s “Squawk on the Street.”

While no independent hardware store owner is going to complain about record sales, it does bring with it a potential large tax liability at the end of the year. There are numerous steps retailers can take to limit their exposure and keep more of what they earned. One program is the Section 179 deduction of the tax code. Since no two businesses are the same, always consult with your CPA or financial advisor to discuss your specific situation.

So, what is Section 179 and how can it potentially help you reduce your tax liability? Section 179 has been part of the tax code since 1943. It allows small businesses to deduct the full purchase price of qualifying equipment and/or software during the tax year instead of a traditional depreciation schedule.

The deduction came under scrutiny when business owners began purchasing expensive SUVs and taking the full deduction. It was often referred to as the “Hummer Deduction.” The tax code has since changed and limitations and specific criteria were added for vehicles, but vehicles used in business still qualify.

The deduction limit for 2020 is $1,040,000 and the spending cap is $2,590,000 before any reduction. The ability to finance the equipment over a period and still take the full deduction in 2020 creates an excellent opportunity to further invest in your store.

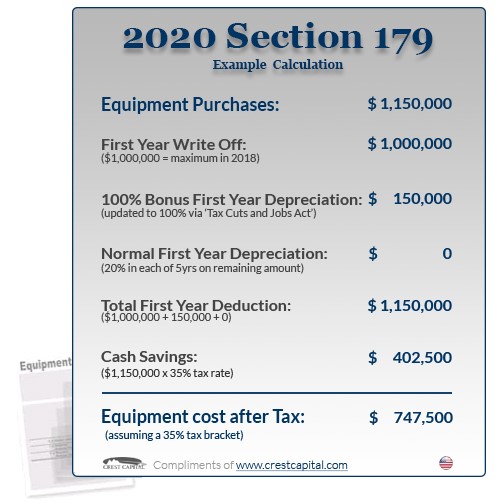

Section179.org is a website compiling all information related to Section 179 and even offers a calculator to see the impact of the deduction. To the right is an example calculation illustrating a cash savings of $402,500 with an equipment purchase of $1,150,000.

Just one of the benefits of Section 179 is the numerous categories considered qualifying equipment which hardware stores utilize daily. Here is a general list: machinery, computers, software, office furniture, vehicles or other tangible goods. The Section179.org website has an extensive list of qualifying equipment.

In order to qualify, the equipment must be put into service during the 2020 calendar year. Even business equipment purchased to comply with COVID-19 restrictions can qualify. Additionally, if you received any Paycheck Protection Program (PPP) funding you are still eligible to claim the deduction.

The Section 179 deduction can not only benefit your bottom line, it could also increase your end-of-the year sales on bigger-ticket items. How many of your commercial accounts know or could benefit from the deduction? Hardware stores already stock numerous products that qualify for the deduction and could further boost sales heading into 2021.

Marketing the deduction to your commercial accounts could not only boost your sales, but also enhance your relationship with these key customers. Instead of just selling them products you are also providing valuable information to improve their business. That is a true win-win scenario.