Orgill’s Boyden Moore Outlines Improvement Initiatives

Boyden Moore, Orgill’s president and CEO, gave a presentation in Dallas as part of the company’s fall online buying event. What follows are some of the highlights of his presentation.

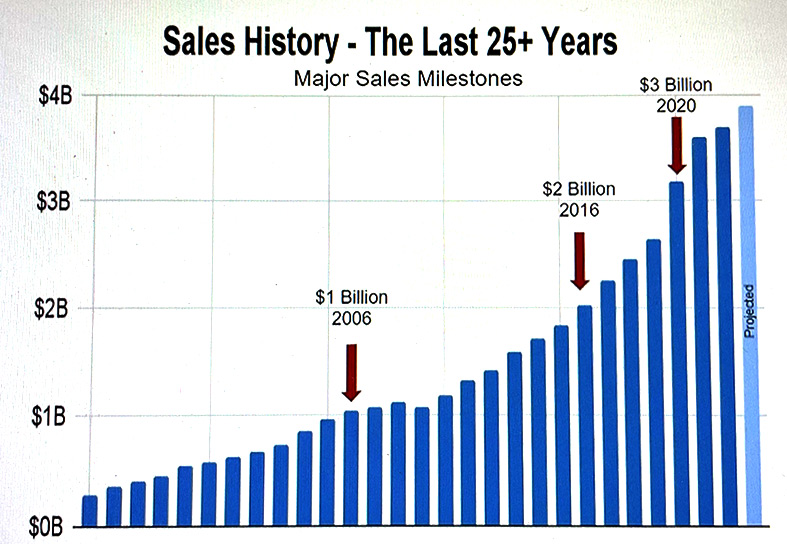

Orgill hit $1 billion in sales in 2006, $2 billion in sales in 2016 and $3 billion in sales in 2020, according to Moore, so the company’s growth rate has been accelerating. “We opened our second distribution center ever in 1995, so it’s a history of 160 years with one distribution center as a regional distributor and just the last 27 years growing into what we are today. Now we have over 13,000 stores in all 50 states, all provinces and territories of Canada and more than 50 additional countries. We’ll have just under $4 billion in sales this year,” he said.

Improving the Supply Chain

The company has been growing aggressively over the last 20 years, even more so during the pandemic. “And during these last three years we had the lowest service levels we’ve ever had, dropping to a low of 77.9 percent in 2021,” Moore pointed out. Service levels were up to 86.9 percent in June 2023.

“We’ve made some good progress getting it over 80 percent but have experienced some resistance. We do expect to achieve 90 percent by September and 95 percent by the end of the year. Restoring the dependability of our supply chain has been the number one focus for us the last three years,” he added.

Moore continued: “We think our industry-leading growth is directly driven by intense focus on our mission to help our customers be successful. If our customers are successful, we believe we can be successful. We are constantly challenging ourselves to constantly think of new ways to help our customers be successful.”

He added, “We believe Orgill can be an important part of any independent dealer’s success, even if we’re not your primary distributor. Roughly 32,000 independent dealers make up about half of industry sales. We ship to 35 percent of the industry. We serve over 1,300 Ace stores, over 800 True Value stores and over 400 Do it Best dealers in addition to dealers who have us as their primary distributor.”

Orgill has invested in the newest and most modern distribution network in the industry, Moore pointed out. “We opened our newest DC in Rome, N.Y., in 2021, accelerating plans to open to meet rising demand during the pandemic. We also expanded our Hurricane (Utah) DC and are now replacing our oldest DC in Tifton, Ga., which will be complete in first quarter 2024. These three projects represent over $220 million of investment in our distribution network in just three years. We have invested to ensure we can drive your costs lower to have the most modern distribution network in the industry,” he said.

Distribution Center Efficiencies

Moore touted the introduction of PopPick Next-Gen Picking solutions with robots to improve their distribution efficiency in the new Tifton distribution center, allowing the company to save 50 percent of operating costs. Some of the features of this technology include:

- Improves warehouse storage density by 400 percent and can store 12 totes in a row. Can fit 10 rows of totes in 3.7m high rack.

- Optimal and comfortable picking height; automatically moves totes to picking station; improve productivity with two-point picking; can simultaneously move 60 totes with a mobile rack.

- Intelligent mapping allows robots to operate simultaneously, doubling throughput capacity.

- Order forecast algorithm facilitates automatic tally for four times the transportation efficiency.

- Artificial Intelligence organizes goods during idle time based on order forecast.

Developing Customized Retail Solutions

Orgill has experienced unprecedented growth over the past three years. To accommodate this growth, Orgill has announced that the company will be making an investment to expand its field sales team by as much as 10 percent. Orgill’s plan to increase the size of its sales team is aligned with the company’s commitment to make investments that will directly benefit its customers.

Orgill has to be a lot of things to a lot of people, Moore said, pointing out that 32 percent of their customers are pro dealers, 30 percent are hardware, 22 percent are home centers and 16 percent are farm stores. Farm is the fastest-growing segment, increasing from 4 percent of business a few years to 16 percent today. “We recently converted all 22 CAL Ranch Stores out west,” Moore said.

Orgill’s largest customer is Central Network Retail Group (CNRG), which buys more than $200 million a year from Orgill, Moore said. CNRG currently has 18 retail brands in 16 states with 144 stores doing $580 million in sales.

“We specifically wanted to work with CNRG to close the performance gap we saw between the big boxes and the independent channel. Then deliver all those retail tools to our customers—that’s integrated into our mission,” he added.

New and Expanded Concept Center

Orgill is investing $65 million in a new and expanded Concept Center that will be used to supplement what the company does with other in-person and online buying events but in a more customized way. At nearly 500,000 square feet, it will be twice the size of the current Concept Center.

“The Concept Center is where we do all customized work with our customers, preparing for the annual dealer markets, hosting vendor line reviews, bringing merchandise insights into focus—some of which we learn and test in our CNRG stores. In addition to more space, we will also have more meeting rooms so we can host multiple vendors and customers at the same time. It will be more convenient for staff and closer to the home office, making the home office a campus that include the Concept Center,” Moore said.

He continued, “Perhaps you can imagine how we can use this facility in new ways, supplementing what we do with other events but in a much more customized way. When the Concept Center is completed in early 2025, we plan to use it to supplement how we connect in-person with customers by continuing to drive further innovation in how we do online buying events. Investing in the Concept Center is part of our event strategy, moving to one in-person event each year in the spring.”

Moore noted that the Cleveland Research Group is projecting 2023 industry sales to be down 2.3 percent and up only 0.5 percent in 2024. Orgill’s sales are projected to be flat for 2023, up 2.0 percent in 2024 and up 5.0 percent in 2025, as the company continues to outperform the industry, Moore said.

He concluded: “We are investing in technology and management infrastructure to do all of this with the best people and technology in the industry. Our technology investment is pretty big and it’s paying off in ways you’ll never see.”

As an example, Moore noted that Orgill suffered a cyber attack at 3:30 that morning, which took seven servers down. “In six hours, our team rebuilt seven servers during our Online Buying Event and restored everything. That’s why we’re investing more in cybersecurity,” he said. “We believe in the strength of the independent channel and the strength of our customers and see a much more stable sales environment on the horizon than we had the last three years,” Moore said.