Ace Hardware Reports Record 2Q 2022 Results

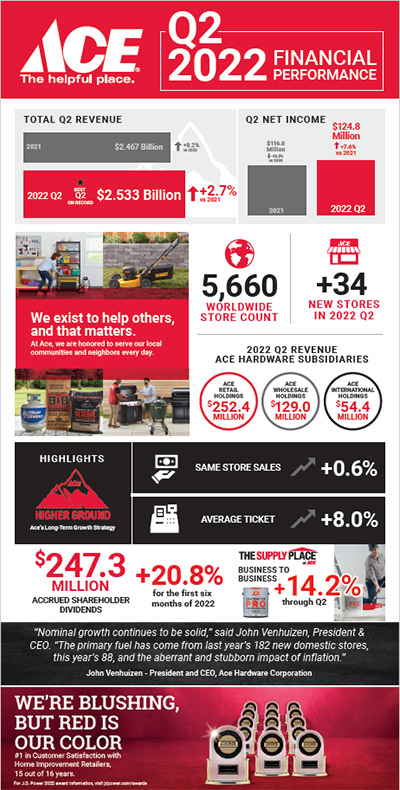

Coming off its Fall Convention last week, Ace Hardware Corp. reported record second quarter 2022 revenues of $2.5 billion, an increase of $66.1 million, or 2.7 percent, from the second quarter of 2021. Net income was $124.8 million for the second quarter of 2022, an increase of $8.8 million from the second quarter of 2021. Included in the results for the second quarter are $10.8 million in non-recurring charges related to the closure of The Grommet.

“Nominal growth continues to be solid,” said John Venhuizen, president and CEO. “The primary fuel has come from last year’s 182 new domestic stores, this year’s 88 and the aberrant and stubborn impact of inflation.”

The approximately 3,600 Ace retailers who share daily retail sales data reported a 0.6 percent increase in U.S. retail same-store-sales during the second quarter of 2022. Estimated retail price inflation of 11.4 percent helped drive an 8.0 percent increase in average ticket. Same-store transactions were down 6.9 percent.

Consolidated revenues for the quarter ended July 2, 2022 totaled $2.5 billion. Total wholesale revenues were $2.3 billion, an increase of $63.4 million, or 2.9 percent, as compared to the prior year second quarter. Increases were seen across a majority of departments with outdoor power equipment, plumbing, paint and outdoor living showing the largest gains.

The Company’s Ace International Holdings, Ltd. subsidiary experienced a $19.4 million decrease in wholesale revenue versus the second quarter of 2021, while Ace Wholesale Holdings LLC reported a $8.7 million increase in wholesale revenues from the second quarter of 2021.

Total retail revenues for the quarter were $258.0 million, an increase of $2.7 million, or 1.1 percent, as compared to the prior year second quarter. Retail revenues from Ace Retail Holdings LLC were $252.4 million in the second quarter of 2022, an increase of $3.7 million, or 1.5 percent, from the second quarter of 2021. This increase was driven by new stores added by the Westlake Ace Hardware and the Great Lakes Ace Hardware chains since the second quarter of 2021. Westlake and GLA together operated 215 stores at the end of the second quarter of 2022 compared to 211 stores at the end of the second quarter of 2021.

Retail revenues from Ace Ecommerce Holdings LLC were $5.6 million in the second quarter of 2022, a decrease of $1.0 million, or 15.2 percent, from the second quarter of 2021, which was due to the announcement of the closure of the Grommet.

Ace added 38 new domestic stores in the second quarter of 2022 and cancelled 12 stores. The company’s total domestic store count was 4,816 at the end of the second quarter of 2022, which was an increase of 87 stores from the second quarter of 2021. On a worldwide basis, Ace added 46 stores in the second quarter of 2022 and cancelled 12, bringing the worldwide store count to 5,660 at the end of the second quarter of 2022.

Wholesale gross profit for the three months ended July 2, 2022 was $287.3 million, an increase of $24.1 million from the second quarter of 2021. The wholesale gross margin percentage was 12.6 percent of wholesale revenues in the second quarter of 2022, up from 11.9 percent in the second quarter of 2021.

Retail gross profit for the three months ended July 2, 2022 was $114.5 million, an increase of $0.8 million from the second quarter of 2021. The retail gross margin percentage was 44.4 percent of retail revenues in the second quarter of 2022, down slightly from 44.5 percent in the second quarter of 2021. Retail gross margin includes a $0.9 million charge for inventory write-downs at The Grommet.

Wholesale operating expenses increased $3.0 million, or 1.6 percent, from the second quarter of 2021. Retail operating expenses increased $12.1 million, or 17.5 percent, from the second quarter of 2021. Receivables increased $81.5 million from the second quarter of 2021 due to higher sales volumes and datings for seasonal programs.

Inventories increased $329.7 million from the second quarter of 2021 due to the intentional build-up of inventory as a hedge against supplier shortages and to increase fill rates to Ace owners. In addition, the late arrival of spring weather in 2022 has resulted in an overstock of patio and lawn and garden inventory that will be carried over into the 2023 spring selling season.

Long-term debt, including current maturities, increased $142.7 million versus the second quarter of 2021. At the end of the second quarter of 2022, long-term debt consisted of $191.8 million outstanding on the revolving credit facility, and $36.7 million owed to former retailers.